Who We Are

We are a financial planning and investment advisory firm. Our business is "You" and your financial well-being. We believe advice and planning should go well beyond simple asset allocation. It’s about your entire life and managing the complexities that come along with it; All the twists, turns, ups and downs.

We at InvestFirst can pull it all together with sophisticated advice and a detailed plan for the long term investment. Our mission is to guide you in your journey to fulfill your financial dreams. Our guidance consists of informed and professional advice on which path to take and which not to.

To handhold you through this journey we have assembled a group of the brightest and most caring financial planners and investment professionals having vast experience and equipped with the industry’s most sought after certifications and credentials.

Serve Others

We put the needs of our clients first

Listen Deeply & Speak with Care

We come to each conversation with an open mind rather than having the ‘right answer’. We tell the whole truth to our clients and ourselves

Bring Genius

We do what we are best at

Enjoy

We believe that your time with us should be the best years of your life

Why Financial Planning

Average Indian takes 36000 financial decisions in his or her life.

Where can bad decisions lead you?.

At Age 65

25%

Were still working, can’t afford to quit

66%

Were dependent on children & charity

As an Employee

60%

Find it difficult to meet household expenses

75%

of them are not prepared for sudden loss of income

As a Family

80%

of their goals are reached after borrowing

30%

are worried they can’t afford kid’s education

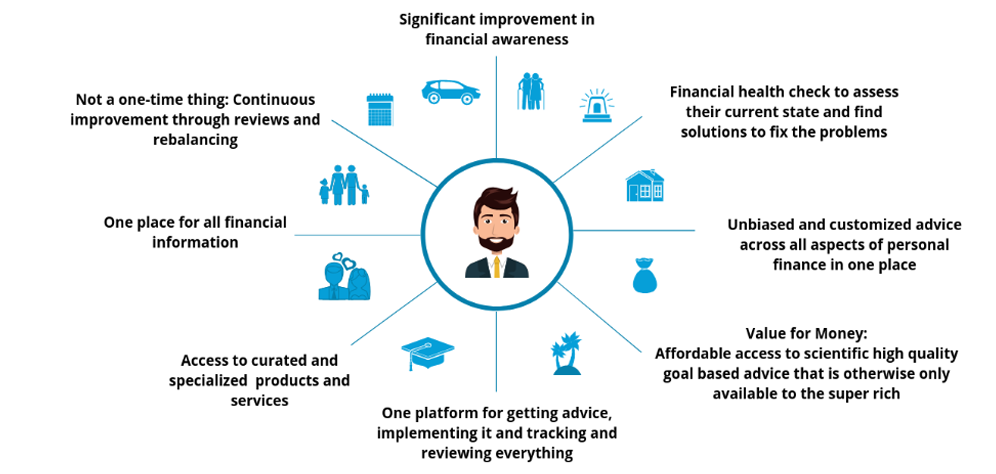

Benefits For YOU

Services

Having your own money in your hand every month does not guarantee you the lifestyle you deserve throughout your life. Circumstances and needs keep changing. Today's comfortable financial situation does not guarantee an equally sound future.So you would need to plan and manage your current income and your future income according to your life cycle needs.

Here'Financial Planning' comes into play.

In life, making those decisions on your investments or insurance or expenses are scary and yet, unavoidable. An average Indian loses at least INR 1 Crore by making the wrong financial decisions during their lifetime. This is where we come in to take care of your financial decisions so that you can live a life that you always wanted. So Leave Your Financial Decisions To Us.

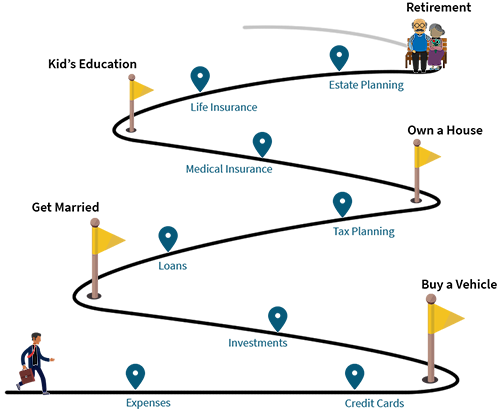

Goal Based Planning

In many areas of our lives, the importance of goal-setting

seems obvious. If you go on a diet, you commit to losing a certain number of pounds. When you go on vacation, you plan where to go. The same is true for financial planning. Setting clear goals like buying a house, saving for a child's education/marriage, planning for retirement, wealth creation etc. play a primary role in preparing a plan and reaching there.

Investment Planning

Investment planning is very important component of

financial planning.Nowadays a whole range of investment vehicles like stocks, gold, bonds, government schemes, real estate etc are available for you. Different investment vehicles offers different risk levels, income/growth potential, liquidity and tax implications. So a proper investment plan is needed in order to align your investments with your financial goals and secure your future financially.

Risk Management

Risk is the possibility of loss. This risk could be to your life

Tax Planning

Taxes are sure as 'Death'. They are unavoidable. But

Retirement Planning

You don’t plan to work until the day you die. Do you?

All of us have some dreams for our retirement, sipping cocktails on a beach, on a porch in a cozy mountain retreat, or off traveling the places. We believe that 'Retirement' should be the best period of your life, when you can literally sit back and relax or enjoy your life by reaping benefits of what you earn in so many years of hard work. Our team works diligently on a detailed retirement plan for you and review it periodically to ensure that you will have enough money to live on after retiring from work.

Wealth Management

Our wealth management service involves combining

financial and investment advice, estate planning, tax and retirement planning for you. In fact we understand and provide solutions to all of the major financial challenges of your financial life. From your perspective, this means having all financial challenges solved. From our perspective, it means providing a wide range of financial products and services in a consultative way.

Our Products

Selecting the right product to sync your financial plan with your goals is the key

component of a successful financial plan.

Mutual fund

We at InvestFirst determine the most suited mutual fund schemes for you

based on your financial goals, risk appetite and tax implications on future profits. Our in-house MF scheme monitoring system keeps assessing the performance metrics of the various mutual fund schemes. Your investment portfolio is also reviewed periodically to rebalance it and to ensure that it’s on the track to achieve your financial goal.

SIP

We choose suitable mutual fund schemes for our clients to start their

SIPs, based on their financial goals. It doesn't matter where they are located physically, in India or abroad (though NRI's have different tax implications and procedures for investments in Indian MF), our paperless-technology driven processes ensures a hassle free experience for you. We provide you with web and app based support to enable the monitoring of your investments, access analytical reports and to transact online.

Life Insurance

Life Insurance has a lot to offer in terms of financial security and peace of mind. It

ensures that your family is taken care of in your absence. It not only helps in providing coverage for all sorts of risks, but builds an opportunity to help you grow your investments to help meet future costs like children's education expenses, retirement expenses etc.

Our experienced team helps you in determining the right amount of insurance cover that you require and helps to shortlist a suitable insurance plan based on your financial goals and tax planning benefits.

Health Insurance

The astronomical cost of medical care can burn a hole in your pocket and derail

your finances. It will become even tough, if the person, who brings in the money, is now in a hospital bed. All this can be avoided by having a health insurance policy which would lessen your stress in case of medical emergencies.

Our professional team of advisors have in-depth knowledge of the health insurance industry. They guide you right from suggesting the right amount of insurance cover, to assisting you through your purchase journey, to helping in claiming the medical expenses.

General Insurance

Our team assists you in obtaining an insurance cover for non-life assets

Deposits & Bonds

We offer investments in fixed income products like Corporate Deposits/FD

offered by Financial And Non-Banking Financial Companies (NBFCs).Government Bonds issued by the Central and State Governments of India which offers a fixed interest rate and are regarded as "risk-free". Some examples of these bonds are Capital Gain Tax Exemption Bonds, GOI Taxable/Tax-free Bonds etc

Achievements